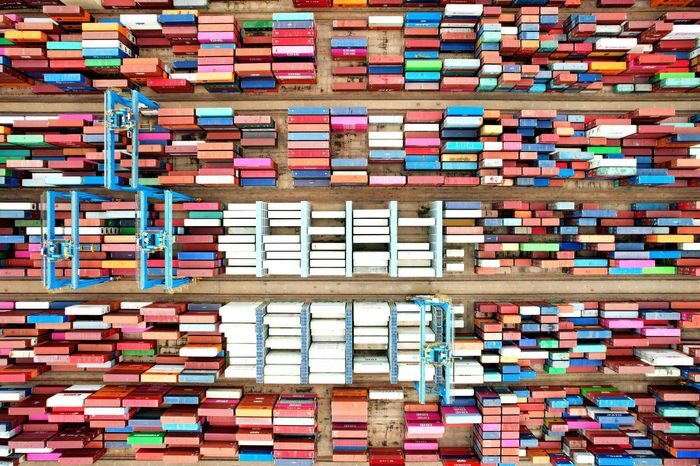

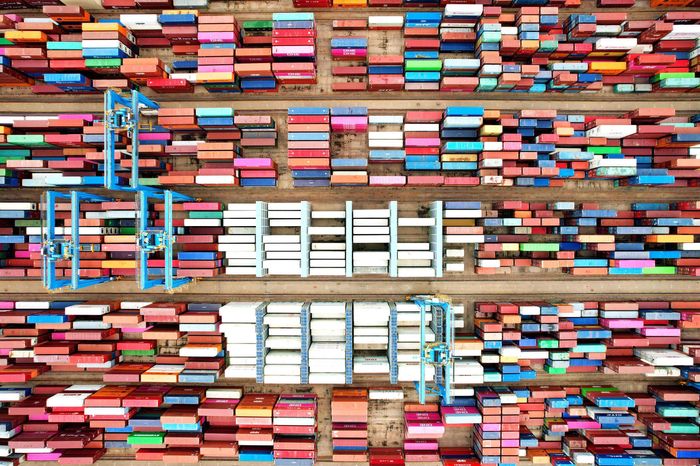

US container ports warn against Trump budget cuts

Stripping hundreds of millions from harbor trust fund will harm critical projects, port chiefs tell lawmakers.

WASHINGTON — Executives from the largest US container and energy ports that had been set to receive close to $330 million this year for maintaining key infrastructure are warning Congress not to accept the Trump administration’s plan to cancel the money.

In a letter sent Thursday to lawmakers responsible for appropriating the Harbor Maintenance Trust Fund (HMTF), the American Association of Port Authorities (AAPA) and 22 port directors asked that they restore requirements agreed to by Congress in 2020 – but which the administration has stripped from its FY25 and FY26 budgets – that allow “donor” ports, which typically include large container ports, along with ports that specialize in energy cargo, to receive a more equitable share of the trust fund as well as to be able to use it for projects other than harbor maintenance.

Donor and energy ports historically have contributed considerably more to the HMTF than they get back in project revenue.

In FY24, approximately $332 million was awarded to such ports to carry out “expanded use” projects across the country.